Resources

Whether you're a first-time home buyer, you're looking to refinance, or have a unique situation, we'll help you understand all your options, so you can have the home of your dreams.

Resources

Whether you're a first-time home buyer, you're looking to refinance, or have a unique situation, we'll help you understand all your options, so you can have the home of your dreams.

Items Needed for Pre-Approval

W2s from the last two years

1040 Federal Tax Returns from the last two years (all pages)

If you are a business owner, you will need business tax returns and K1s

2 most recent paystubs

2 months of recent statements for all assets (checking, savings, money market, retirement, etc.)

Driver’s license or passport

Other documentation may include: offer letter for employment, school transcripts, social security or pension award letters, divorce decree, bankruptcy papers, short sale documentation.

Common Questions

How long is a preapproval good for?

A pre-approval usually lasts 90 days, though some lenders may honor it for up to 120 days. If it expires, updating your information can often extend it.

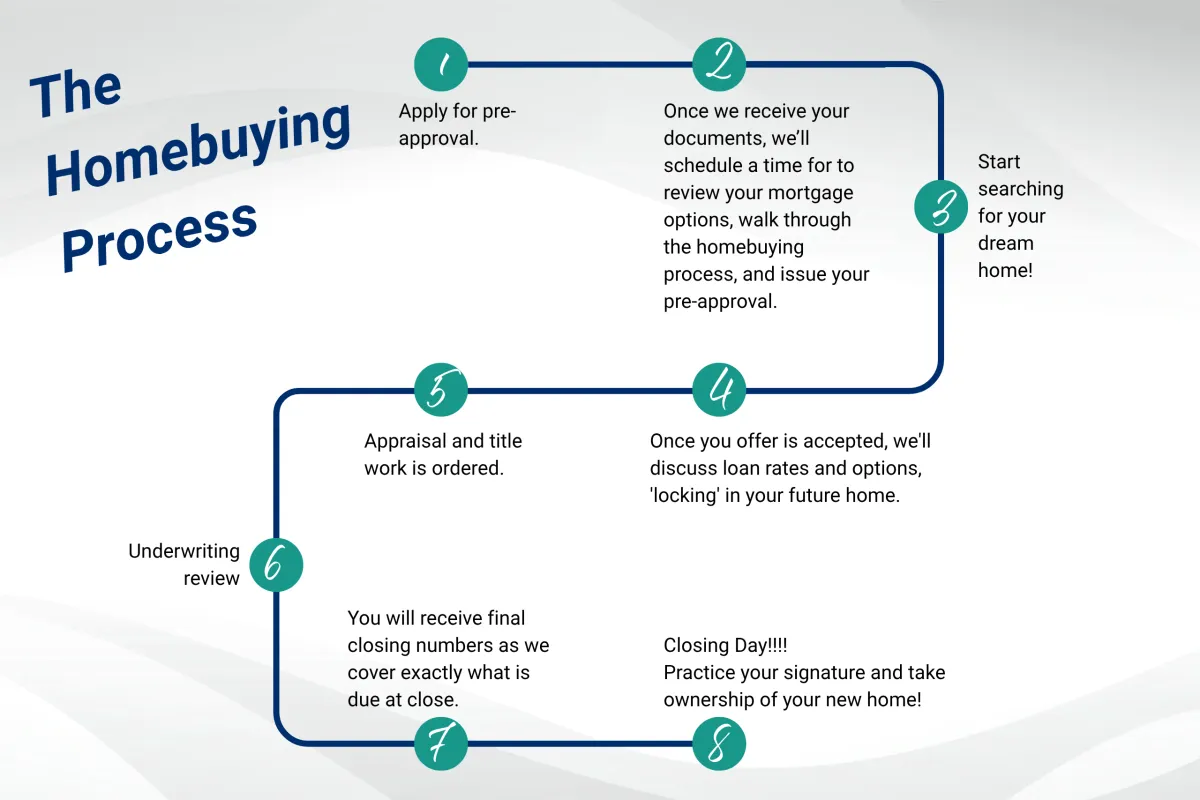

What happens at closing?

Closing is the final step where you sign all necessary documents, finalize your loan, and officially take ownership of the home. You’ll also pay any remaining costs, and then receive the keys to your new home.

How long does it take to get pre-approved?

Pre-approval can take as little as one business day, provided you’ve submitted all required documents. In some cases, it may take a few days if additional verification is needed.

When is my first payment?

Your first mortgage payment is typically due on the first day of the second month after your closing date. For example, if you close in June, your first payment is usually due August 1st.

What are the closing costs?

Closing costs typically range from 2-3% of the home’s purchase price and include fees for the loan, appraisal, title, insurance, and taxes. You'll receive a detailed estimate early in the process so you know what to expect.

Your goals are our starting point

Every journey is unique. Let’s connect and explore how we can help you move forward with clarity and confidence.

We've been helping people like you achieve their dream of homeownership dreams for over 10 years.

This is a loan production office of Ease Mortgage.

Ease Mortgage

1050 Wilshire Drive Suite 300

Troy, MI 48084

© Ease Mortgage 2025 copyright. All Right Reserved.

Copyright © 2025 | Ease Mortgage | NMLS #2273319 | (888) 650-3273

Licensed In: AL, AZ, AR, CA, CO, DC, FL, GA, ID, IL, IN, IA, KS, MD, MI, MN, MT, NE, NH, NJ, NC, ND, OH, OK, OR, PA, SC, SD, TN, TX, UT, VA, WA, WI, WY

All rights reserved. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply.